5 Ways TurboTax Can Teach You to Create an (Almost) Painless Purchasing Process

Filing taxes and corporate purchasing are both painful, tedious processes. But as TurboTax proves, we can make these experiences bearable — even fun — with empathetic design choices.

If TurboTax can make the tax filing process minimally painful and educational for millions of people every year, why can’t finance and procurement software offer a similar experience for employees?

Usually, I don’t like to make comparisons between consumer-focused (B2C) software and B2B technology. Consumers are very different from businesses, and user behavior naturally diverges when you’re spending other people’s money instead of your own. But TurboTax deserves an exception.

The reason why is that TurboTax makes an unpleasant process bearable, even fun to some. And this is where the comparison is most needed, because the employee experience of B2B purchasing is, according to employees themselves, broken. According to our 2023 B2B Purchasing Trends survey, nearly one-third (32.1%) of respondents say their B2B purchasing process is broken, while only 20.9% said the process is working “very well” and that they are not looking to make any changes.

But as TurboTax teaches us, it doesn’t have to be — for taxes or for corporate purchasing.

So, how does TurboTax do it? The secret is first and foremost in design. TurboTax isn’t smart enough to do your taxes for you; rather, TurboTax is smart enough to teach you how to do your taxes yourself. Which, in finance and procurement, is what you want for your stakeholders — not fancy autonomous processes but a system smart enough to teach employees how to buy effectively and compliantly with your guidance.

TurboTax’s brilliance is in making a complex process accessible and coaching you into getting the best results for yourself while reducing risk along the way. How do they do it? There are 5 things that stand out:

- Empathy — reducing user overwhelm through careful pacing of workflows and information

- Education — in-process help text and accessible explanations

- Guidance — conditional logic that creates incentives

- Memory — reducing data entry and cognitive burdens

- Integration — putting the financial ecosystem at users’ fingertips

1. Empathy

Let’s just get this out of the way: Doing your taxes is painful. You sit down with all of these random letters you had to make sure your kids didn’t spill milk on and manually enter a bunch of precise numbers in boxes hoping you get the right result. For most people it goes fine and you get money at the end, but in the back of your mind there’s always the lingering fear of the government rejecting your hard work with an audit:

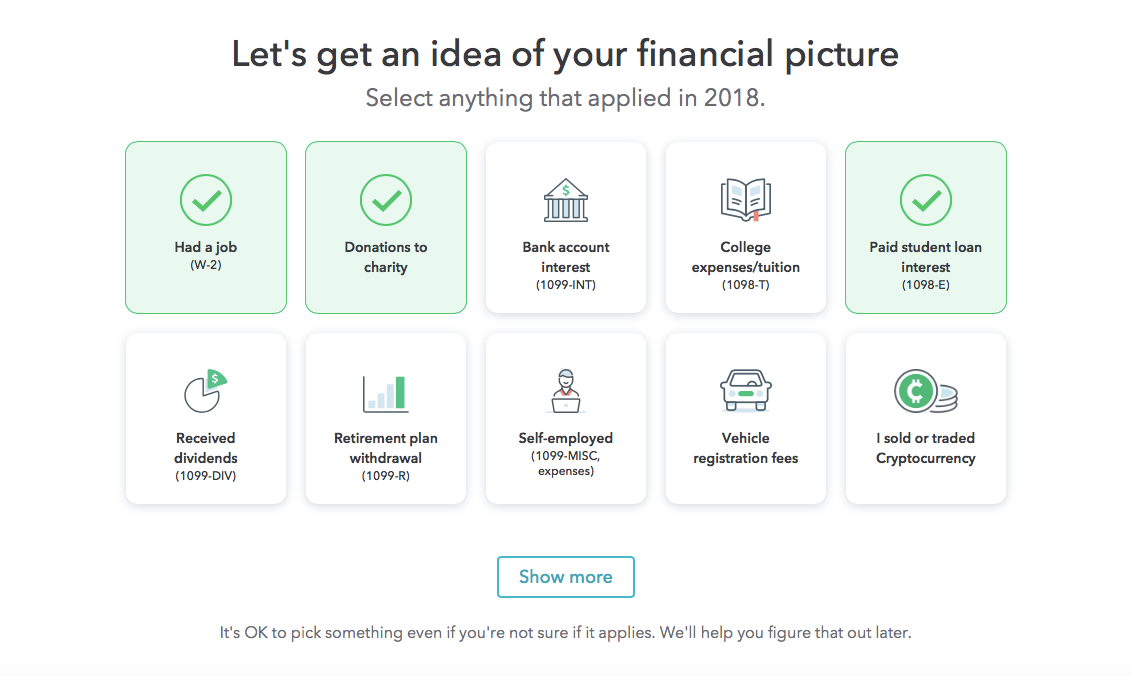

Most people are not accountants and do not think about their taxes until April comes around. TurboTax understands this and emphasizes reducing overwhelm as much as possible in the design of its software with:

- Minimalist interfaces — the UI provides plenty of white space and clear status markers for selections to ensure users know what they’re doing and help them focus on the current task

- Low cognitive loads — users are never presented with more than a few questions per screen, and more complex questions are presented as single tasks

- Nested information — the UI hides uncommon questions or answers but allows power users to reveal greater depth as needed without taxing casual users

Consider the opposite approach: TurboTax could present all of the workflow questions in a given section of the tax form and ask you to scroll down the screen as you complete them (not unlike how purchase requisition forms are set up in most e-procurement systems, if we’re honest). But if you get stuck on a question or hit an error message, you’re stuck mid-page and you’re overwhelmed with the fact that you still have more work to do. Which only increases the odds of a stakeholder avoiding the form, since you can’t send someone in marketing to jail for rogue spend.

How to apply empathy to your purchasing process:

- Create dynamic intake forms for purchase requests that collect only needed information by category, purchasing type, etc.

- Show progress through workflows and proactively communicate the status of requests, so requestors have a sense of completeness as they submit information

- Reduce overwhelm by showing only single or small groups of questions at a time for forms

2. Education

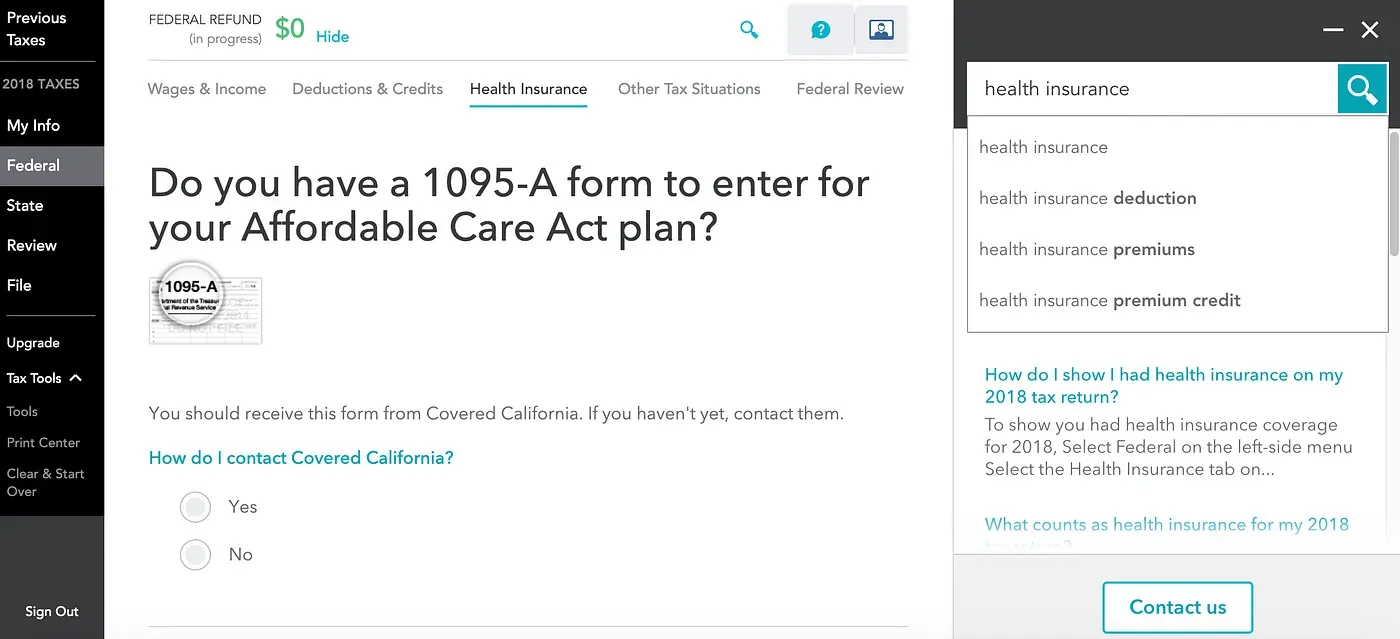

The IRS maintains more than 800 forms and schedules for filing taxes. On top of that, the tax code changes periodically, meaning the way you filed last year might not be how you file this year. Filing your taxes requires knowledge of the policies and processes inherent in tax law. If you’re not a tax lawyer, that’s kind of a burden.

TurboTax alleviates this pain by embedding tax knowledge into the logic of its workflows and providing user guidance and term definitions in the context of each question. This idea sounds simple on the surface, but in practice determining how to supply supporting information at the right points and in what amount is incredibly nuanced.

In the B2B purchasing world, this level of in-context guidance is almost non-existent. Instead, users are expected to consult PDF- or PowerPoint-based user guides for tasks even as simple as determining which type of form to use or what appropriate data inputs certain fields can take. This is a symptom of many systems requiring tools outside of the tool to get actual work done. What’s more, as purchasing policy changes, these updates need to be manually pushed and enforced by finance/procurement teams, a practice that often creates change management fatigue and animosity at worst.

How to apply education to your purchasing process

- For policy-heavy questions in your purchase request forms, provide in-context hyperlinks to policy documents so requesters can quickly review and assess information (e.g., data privacy requirements)

- Offer quick definitions of finance/procurement jargon, either as parentheticals in options or as “hover text”

- When additional documentation is required, not only show that a specific document must be uploaded but explain why and the risk of not providing it for the company

3. Guidance

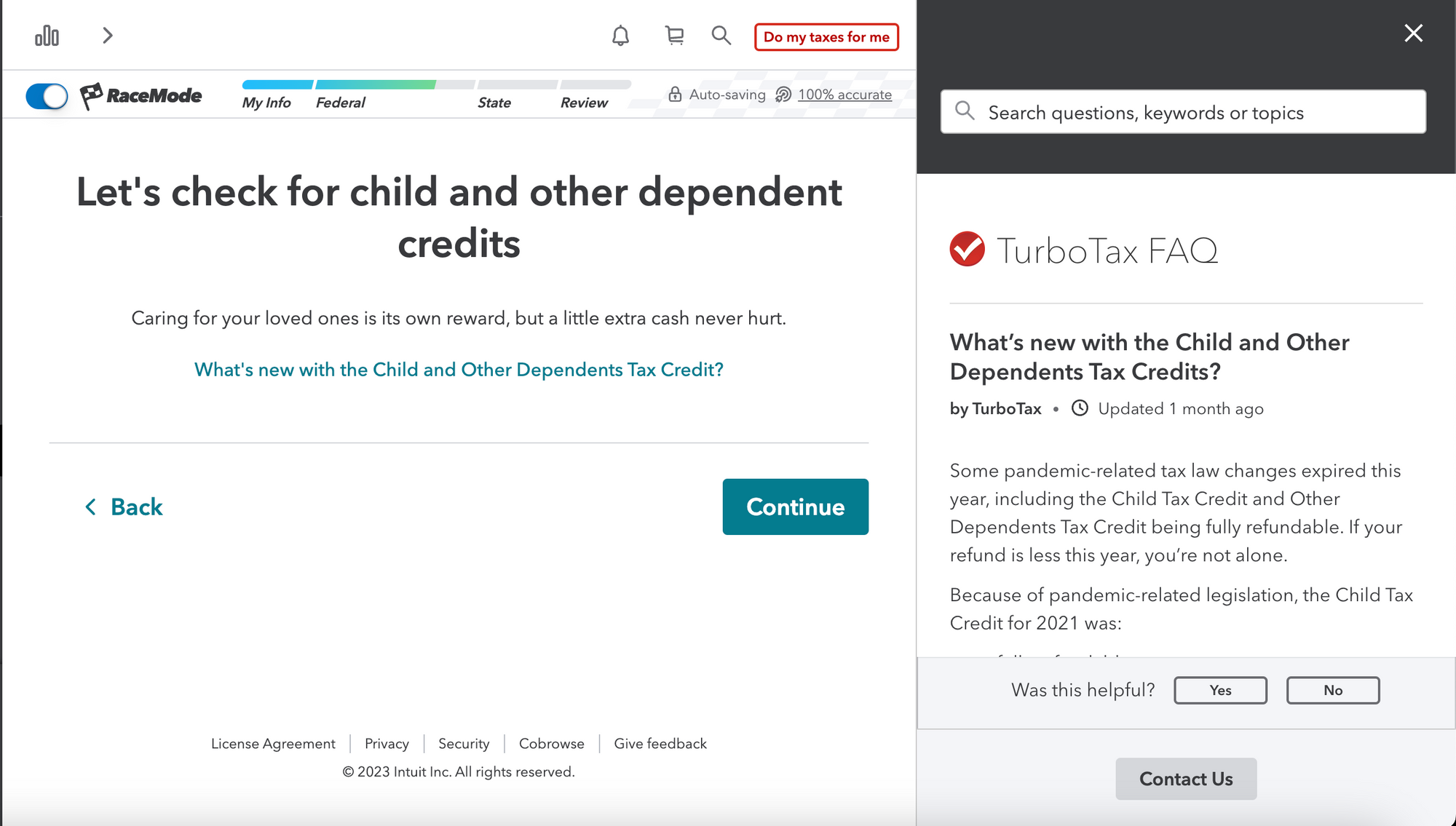

Guidance is subtly different from education. It’s about showing users the results of their actions, whether that's progress through a workflow or the consequences of making a specific choice for the ultimate outcomes they’re aiming to achieve.

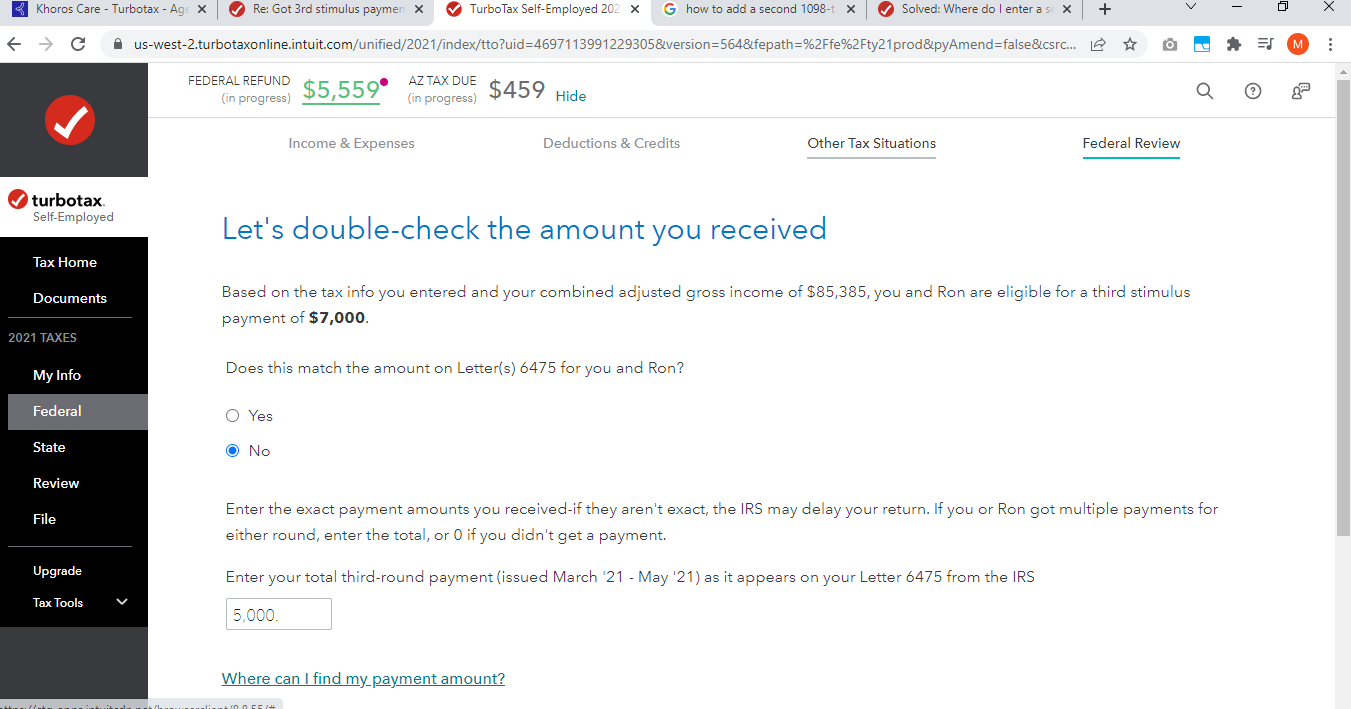

In TurboTax, the goal is to file your taxes as fast as possible while mitigating risks and obtaining the maximum refund available. Using TurboTax usually costs you money, and they will of course try to sell you on premium features as you go along, but you practically forget that because of the design. Because right front and center from the start and throughout the experience is the best kind of progress meter: a calculation of your potential refund.

The idea here is more than a simple progress meter like you’d see on a news article as you scroll to the bottom. It’s that the system adapts to your behavior to show what and why something happens when you take an action. Selecting a specific tax credit computes a new refund total automatically. After e-filing your taxes, TurboTax sends proactive updates by email or text on the status of acceptance and estimated arrival times of your refund if applicable.

When stakeholders interact with procure-to-pay systems, they are instead greeted with black boxes. They submit purchase request forms or invoices and are merely met with a confirmation screen. They get no idea of the impact of what they’ve sent or what the expected response time will be. Suppliers are often the worst off of the bunch, as they are frequently given no more than the most basic portal view into a system for inquiries like payment status, with only vague descriptors like “pending" available. Which usually results in a follow-up email to finance or procurement personnel to resolve, creating low-value work to triage.

How to apply guidance to your purchasing process:

- Show the implications of answering certain questions or making certain purchase requests for stakeholders by visually communicating the resulting approval workflow with clear next steps

- Provide SLA estimates and benchmarks for each approval step, along with the specific contact and communication method (e.g., threaded comments) to create transparency into the process for stakeholders

4. Memory

At this late stage of enterprise digital transformation, there is a lot of data already in existence. This means there are already precedents for what users need to fill in, and suppliers have likely submitted previous versions of company or RFP data in the past.

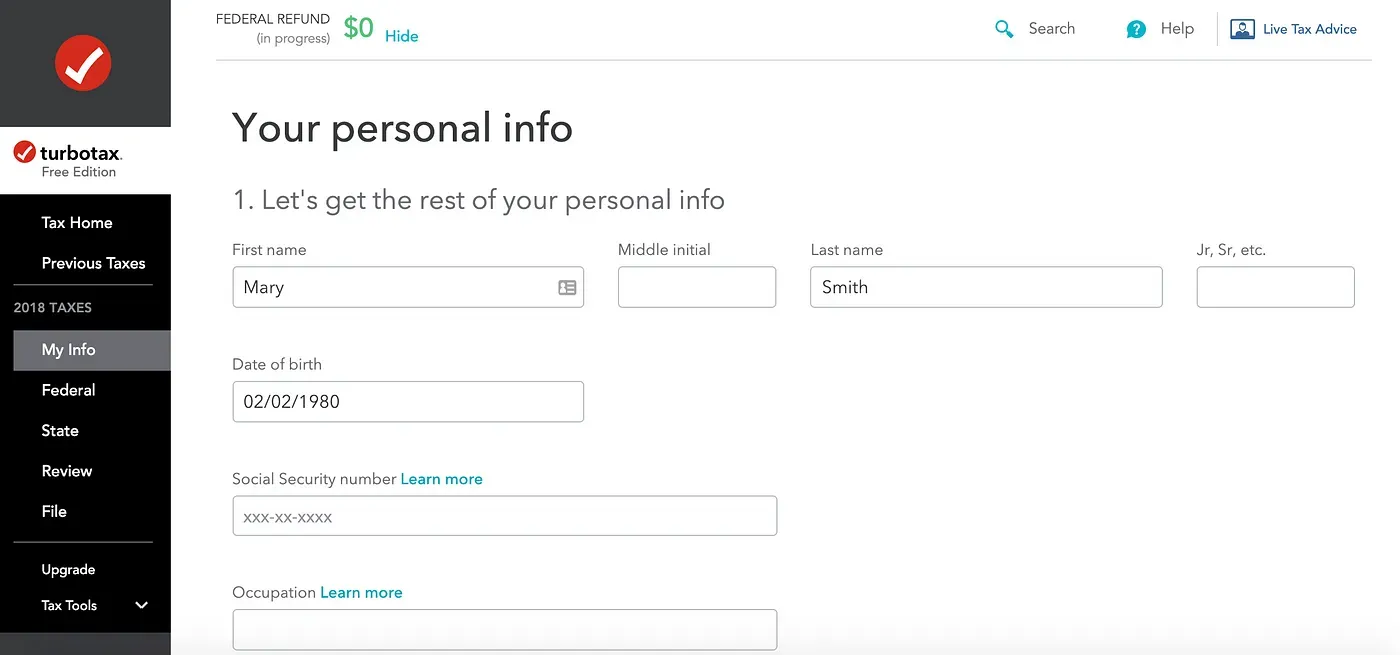

With TurboTax, the same precedent applies. You come back every year, and most often you have the same name, the same family members, and you make the same donations you did last year. Fortunately, TurboTax doesn’t require you to manually rekey all of this information; instead, it simply asks if anything major has changed year-over-year, and if not you can dash through the workflow to get to something that might actually be different.

TurboTax’s approach to memory also applies to the workflow itself. The system acknowledges that you probably won’t finish filing your taxes in one go. So when you come back to finish the deed, it allows you to pick up right on the question you left off on, rather than kicking you back to the start of the incomplete workflow.

The typical paradigm in B2B purchasing is not this. The term “portal fatigue” exists because suppliers are constantly being asked to provide additional information and documentation, which they then need to manually enter into the multiple heterogeneous supplier networks they interact with.

How to apply memory to your purchasing process:

- Deploy a supplier network with a many-to-many model that allows for robust information and credential sharing

- Create simplified or nested workflows that allow for stakeholders to complete requests on their pace vs. requiring full submission in a single session

- Apply user- or role-based profiling to suggest common request types and value/amounts to accelerate data population

5. Integration

While there may be a plethora of data out there in the enterprise software universe, it does not all exist in a single location. As we explored previously in our examination of tech stack fragmentation, multi-vendor strategies have both pros and cons, with one of the major drawbacks being the ability to consolidate data easily across systems.

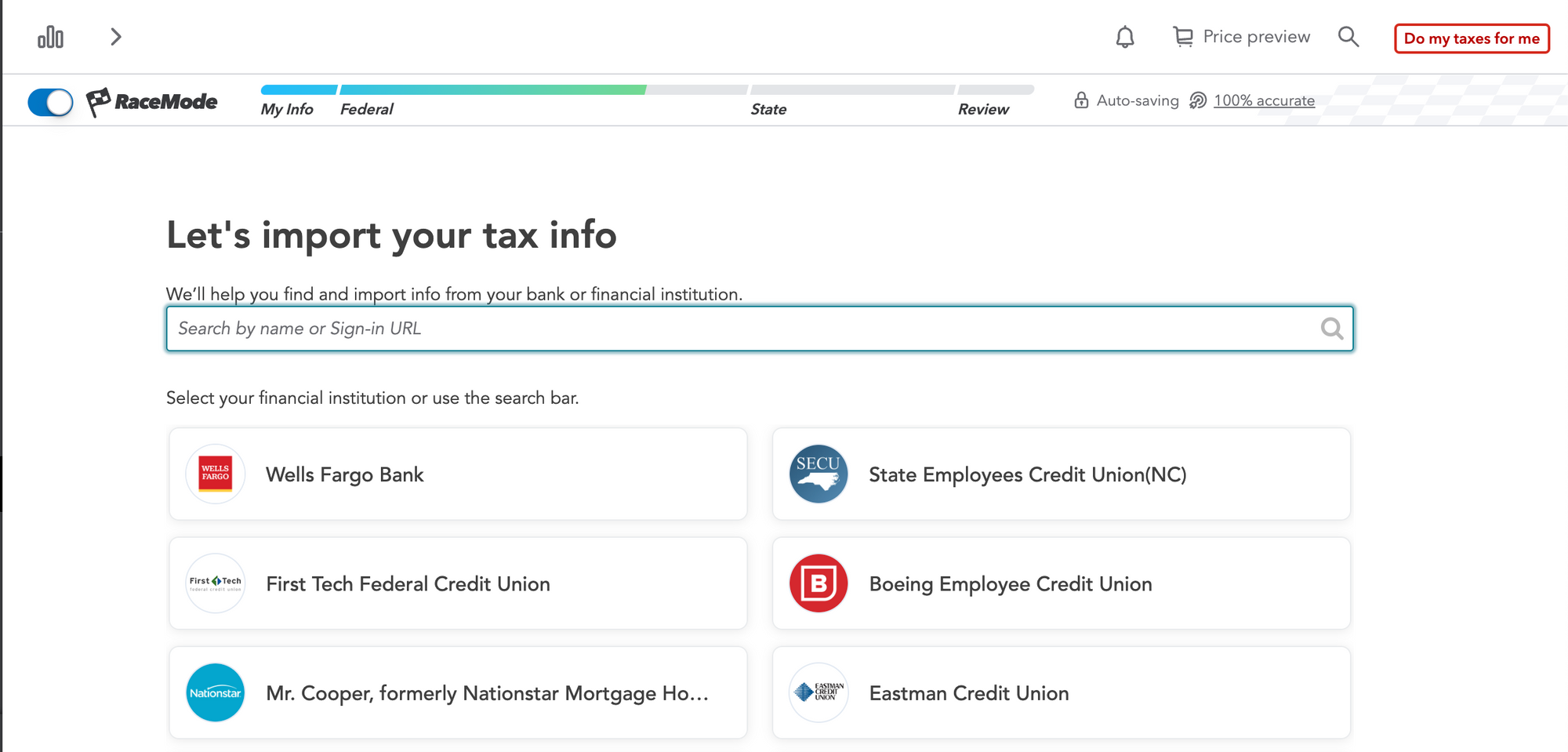

In tax filing, the same is true for account balances and W-2s and the like. The data exists, just somewhere outside of your grasp. In the past, filing taxes required you to compile a disparate stack of letters and forms and neatly proceed through copying the data from each of them into tiny boxes. Today in TurboTax much of this data is integrated by Plaid, which makes it incredibly easy to populate forms. Did you get a W-2 from a major HR outsourcing company? Just enter their company ID and TurboTax will pull your wages. Have mortgage interest to deduct? Click the logo of your loan servicer and TurboTax will fill the needed 1098-T boxes automatically.

Enterprise software, of course, is not known for such simplicity. In fact, integrations are the bane of most implementations, and not having support for specific niche integrations can disqualify a vendor from an otherwise strong partner scenario. Plus, even when integrations are supported for the needed systems, figuring out issues of custom fields (e.g, for ERP) and the appropriate schedules for data push/pull can be tedious. (Although there should be improvements on the horizon — I, for one, am very interested to see if something like Rutter, which offers a universal API for accounting integrations, can create a more universal standard for B2B purchasing integrations.)

How to apply integration to your purchasing process

- Provide integration support in the flow of the purchasing process (as TurboTax does at the question level)

- Offer connections to not only other common systems but useful data sources to verify information or risk levels (e.g., D&B, BvD)

- Make the integration experience seamless for users, with automatic triggers and as close to real-time updates as possible for in-workflow updates

Your Stakeholders Need TurboPurchasing

The tax code is anything but simple, which is why an army of tax preparers and CPAs exist to help you get through the process of filing every year. To be sure, those people probably do the absolute best job possible at preparing your taxes. But for most of us, our tax situations are not so complicated that we can’t muddle through ourselves with a little help.

The major takeaway of what makes TurboTax so impressive, in my view, is that you can actually automate a lot of complex requirements with strong enough software. The trap is thinking that the burden needs to be borne by someone, either internally for purchasing or by stakeholders, in order for the process to be done correctly. Because when structured and designed effectively, software becomes a sort of third person in the equation that can educate, guide, and empathize with process participants to drive people toward mutually desired outcomes.

So if you’re like me and are inching toward that “e-file” button this weekend, take a moment to reflect on how the expected pain of a tedious process, whether taxes or purchasing, can be eased by a bit of ingenuity. As TurboTax proves year after year, there’s always a little extra opportunity hiding in the minutiae.

Enjoy this newsletter?

Sign up yourself if this was forwarded from a friend or colleague.

Need help with something? Hit reply to send us research questions or to say hello. We love to trade notes!

Interested in hearing more from Zip? Visit our website or sign up for company updates.

Note: By clicking subscribe you confirm that you have read and understood the Zip Privacy Notice that explains how we collect and use your personal information, and includes directions on opting out from our newsletter. If you have any questions, please reach out to privacy@ziphq.com.