After SVB: 4 Ways CFOs are Preparing for What’s Next

It's time to prepare for a worst-case scenario. There won't be easy answers as CFOs evaluate options, but key themes around treasury management are likely to dominate the next steps.

After an insane week in which the structural integrity of the US banking system was called into question, finance leaders are now asking the only question they can: Where do we go from here?

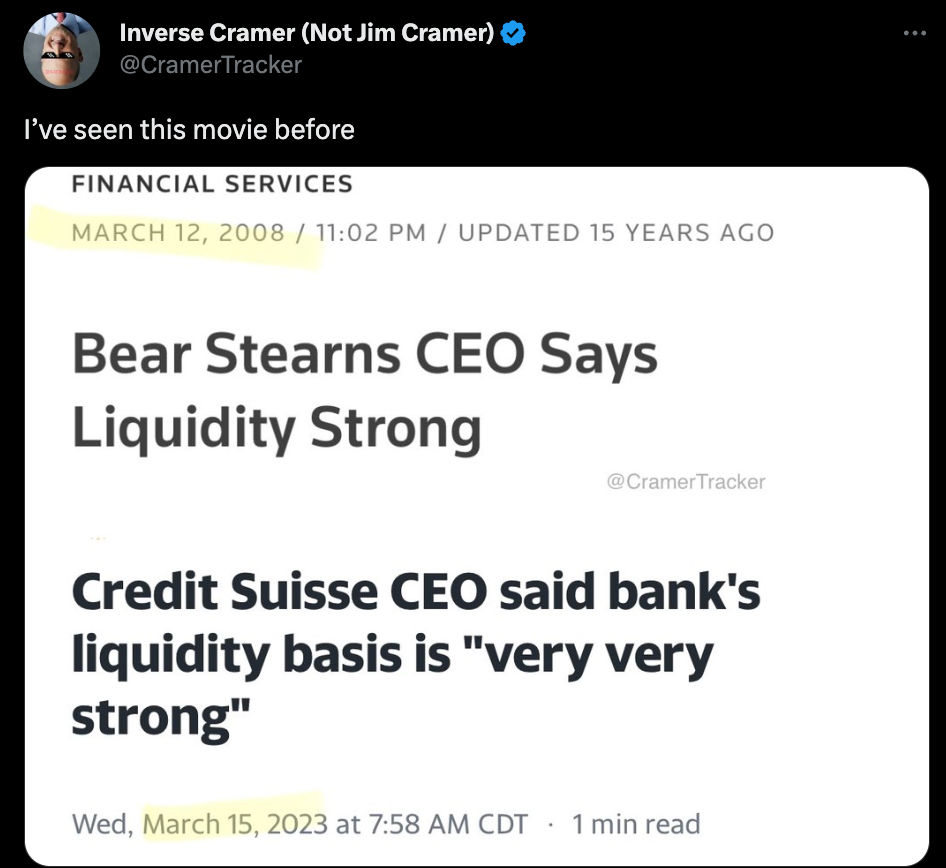

The collapse and closure last Friday of Silicon Valley Bank thankfully did not initiate a September 2008-style economic implosion. But as Sudeep Reddy, senior managing editor at Politico, explained Monday on NPR’s Marketplace, that might be the wrong parallel. SVB might be more like Bear Stearns in March 2008 than Lehman Brothers — that is, a retrospective canary in the coal mine for issues yet to be uncovered.

The themes I’m hearing from senior finance, procurement, and operations leaders are along those lines. It’s time to prepare for a worst-case scenario, and especially if you’re at a smaller or VC-backed company, you need to fast-track capabilities you thought you’d have years to acquire.

So, where do we go from here, then? The path forward includes four areas:

- Communicating immediately how the company’s money will be kept safe

- Resetting expectations for AP and AR in this new climate

- Improving cash management awareness

- Securing and extending financial runway

Reassuring the Board and Investors

In the context of a Black Swan event that had the potential to evaporate a company’s operating cash away, the first thing any CFO needs to do is immediately reassure the board and potential investors on the current state of the company’s assets.

At a public forum event hosted by the Silicon Valley-based Operators Guild on Tuesday, Jim Cook, CFO at Orbital insight, shared a three-part strategy for how to communicate finance’s response effectively:

- Is our money safe? With the federal government now committed to backstopping deposits for any company that had money at SVB, the communication to boards and investors should be that for now, our money is secured by the full faith and credit of the US government (point them to the FDIC memo). And — if you haven’t already — we are actively working to move that money to a systemically important bank like Chase, Bank of America, or Citi.

- How are you ensuring our future money is safe? Bank and payment rail diversification is now a must-have part of any financial strategy, no matter what size company you are. You need to codify and communicate that your organization as a rule now will always have at minimum access to two or three different banks, and that the methods you use to execute payroll and vendor payments are not sole-sourced on a single set of payment rails.

- What is your strategy for ensuring future flexibility? Your cash and investment strategies need to be clear and aligned to the current environment. Explain how you are utilizing sweeps for near-term stability and liquidity. For longer-term investments, communicate how you are balancing interest rate hike expectations accordingly.

To be clear, this is just step one. Much like the government is trying to do right now for the banking system, at the micro level you need to reassure that you’ve handled the immediate issue, you’re taking immediate steps to reduce exposure to systemic risks, and you’re planning ahead for future instability.

Reset AP and AR Expectations

The dust from the immediate crisis may be settling, but that doesn’t mean you can sit still. Unfortunately, the resulting decline in economic confidence will likely result in hesitance to spend and a desire to hold onto cash as much as possible. What’s more, VC-backed firms are all expected to have a significantly harder time raising money going forward — even harder than it already was in early 2023 — shortening runways and thus making the need to conserve cash even greater.

For finance leaders, that means whatever you were planning to pay and what you were expecting to be paid needs to be re-evaluated. I’ve even heard some nervous CFOs saying they want to be proactively involved in AP/AR processes going forward, rather than leaving it to their accounting colleagues.

For AP, the strategy is clear: you need to push out payment terms where you can, and anything new coming in will be on the longest payment terms possible that the vendor will accept. If you’re not already using some form of v-cards or, if you have the cash, looking at dynamic discounting, it might be a good time to check with whoever supports your AP automation and payments capabilities if these are available to you (or explore add-ons to accounting software/ERP if you don’t yet have this).

Companies that are already seeing the fiscal cliff approach more rapidly will undoubtedly begin asking for payment schedule modifications and payment plans. From the AP side, this is a matter of survival. But one company’s payment plan is another company’s AR write down, and this is where things are going to get rough.

First off, finance leaders need to look at their AR aging reports and perform a stress test. Who is likely to pay me on time, who are we going to need to rewrite onto a new plan, and who is in true danger? If you’re providing a SaaS product or subscription service, this is where hard conversations will need to be had with sales and customer success teams about when services need to be cut off versus flexibly renewed in new ways.

Looking out further, the challenge will be to adjust expectations for AR. Sales resources are finite, and the available budget out in the market for your product or service likely just got smaller. Boards, investors, and CEOs are going to start telling their sales leaders they need to sell selectively to companies that have cash, and to not target prospects who have low chances of paying in the future.

Cash (Management) is King — Get in the Know

The communication strategy in area 1 centered around diversification — you now need more bank accounts and ways to pay, as well as a segmented investment strategy for this evolving environment. The crux of area 2 is resetting the parameters of your cash position. So area 3 naturally revolves around your capabilities to support cash management. Said another way, this will become a golden opportunity for those with treasury backgrounds or treasury management solutions to shine.

Multiple finance and operations leaders have recently emphasized to me their changed perspectives on treasury. Previously, hiring someone in treasury or acquiring technology specifically for cash management was viewed as a medium-term priority, something that for many was at least five years out. Now there’s an argument that every post-Series A company needs a person actively working on treasury, either part time or, depending on the size of the company, as a full focus. Especially in the context of communicating with VCs and boards, the ability to reassure owners and executives that the business is operating safely is now a differentiating capability.

The other thing I heard was a new willingness to explore and understand the technology out there to support this, specifically treasury management systems (TMS). While before mostly the province of large enterprises, I now expect small and mid-sized companies in the immediate term will begin looking for a right-sized version of TMS. The logic is simple:

- More bank accounts will be needed to realize diversification strategies. The more bank accounts you open, the more administrative work you’re forcing on your accounting teams for reconciliation and the like. TMS solutions provide a “portal of portals” approach to ease bank account oversights and reporting burdens.

- As you open up different types of accounts and positions, you again have more work for your team to manage your investment positions and continuously monitor how currencies, interest rates, etc. will affect your balance sheet.

- Beyond investments, finance leaders will now want to understand how they can optimize their approach to payments. Availability of multiple sets of payment rails and methods will become a critical capability for financial resilience, as will the ability to simulate and assess the best ways to pay and when. TMS often provides the best way to both centralize all of the supporting data streams (AP/AR data, payment terms, fees, etc.).

The heightened interest in treasury capability is both for near-term cash management benefits and more broadly as an orchestration layer that provides interoperability across different bank portals, payment methods, and data sources. Unifying heterogenous ecosystems to optimize for better business outcomes is the objective, with financial resilience as a key result.

Securing and Extending Runway

Once you’ve stabilized and are taking decisive action on near-term fixes, there may (hopefully) be a spare moment to think about the future. But this is raising another uneasy question for finance leaders: how long can we keep this up?

Many of the people I’ve heard from at VC-backed companies are understandably nervous not only about the immediate aftermath of the SVB collapse but also about what it means for their future prospects. To paraphrase, the next fundraising round, if even attainable, is about to get a lot harder.

In response, CFOs and their peers are now replanning runways meant for 12 months and trying to figure out how they can last for 18. Which inevitably means procurement processes need to be tightened and extraneous expenses trimmed (e.g., expect a culling of any SaaS subscription up for renewal that isn't mission critical or that saves money in a visible way). And for larger organizations who can invest in automation or bear the losses by stretching their teams further — not necessarily advisable, but possible — the prevailing theory is that headcount is likely to be the major target for savings, with Meta’s continued layoff waves this week being one leading indicator.

What’s Next

I’ll be blunt on this point: I don’t know. And anyone who says they do probably should be given their own equivalent of an Inverse Cramer ETF.

The point I’ll leave you with, though, is that things are breaking just like they should. Because even if they don’t want to say it, that’s what the Fed is trying to do: break the economy so that it stops overheating. They want to do it as gently as possible, but there’s no guarantee that the process will, in reality, be gentle.

To prepare for the many possible futures and risks, finance and procurement leaders all need to remember they are exposed to human risk. The SVB collapse was a product of a series of choices made (or rather, not made) by risk managers. In retrospect, the delta between SVB’s held-to-maturity assets and their assets if they had been marked to market seems like an obvious risk everyone should have been hedging:

And yet, many of us never thought about this until it was too late. That’s the takeaway here: heed the lessons of hindsight bias and acknowledge that there are strategic risks out there that you might not yet be aware of. Adjusting to operate in a world where you’re preparing for the next unknown thing that will break is now the top focus of all finance and procurement teams.

Enjoy this newsletter?

Sign up yourself if this was forwarded from a friend or colleague.

Need help with something? Hit reply to send us research questions or to say hello. We love to trade notes!

Interested in hearing more from Zip? Visit our website or sign up for company updates.