Signal shift: how CFO priorities are changing through 2023

The year CFOs planned for is not the one they got. Here's how CFOs are navigating a volatile 2023, juggling everything from balance sheet health to treasury strategy and automation.

In the eyes of many finance leaders, 2023 was supposed to be the start of something better. The pandemic era had largely moved to the rear view mirror, and geopolitical tensions, while still high, had been absorbed and refactored into the economic calculus. Fears of an imminent recession had begun to recede, too, as a resilient labor market and consumer spending persisted in spite of gloomy forecasts. Accordingly, many chief financial officers started the year with a bold sentiment: that they were ready to spend on growth.

Of course, that’s not how 2023 played out. Interest rate hikes aimed at taming inflation ate into balance sheets, and weakened financial positions put the US banking system dangerously close to a 2008-style breakdown. Previously well-financed companies started to struggle for funding opportunities, with down-rounds becoming more common in the tech world. Layoffs ensued in waves — a trend likely to continue throughout the second half of the year.

How are CFOs navigating this shift? They’re doubling down on classic defensive moves while adapting to the new requirements of this particular economic environment. In a word, CFOs are juggling. And they’re doing so at what many are calling “the most challenging time of their career.”

Risk jumps the agenda

The major shift in priorities this year for CFOs came from an unsurprising source: inflation. As the Federal Reserve took action to pull inflation closer to its desired 2% target, the resulting increase in borrowing costs has pushed economic and balance sheet risks to the top of board meeting agendas. In a sign of the times, a recent Deloitte CFO Signals report found that 81% of CFOs put economic/ financial market risks at the top of their organizations’ most worrisome external risks. This is a stark contrast to prior iterations of the survey, in which geopolitical risks took the spot for top risk.

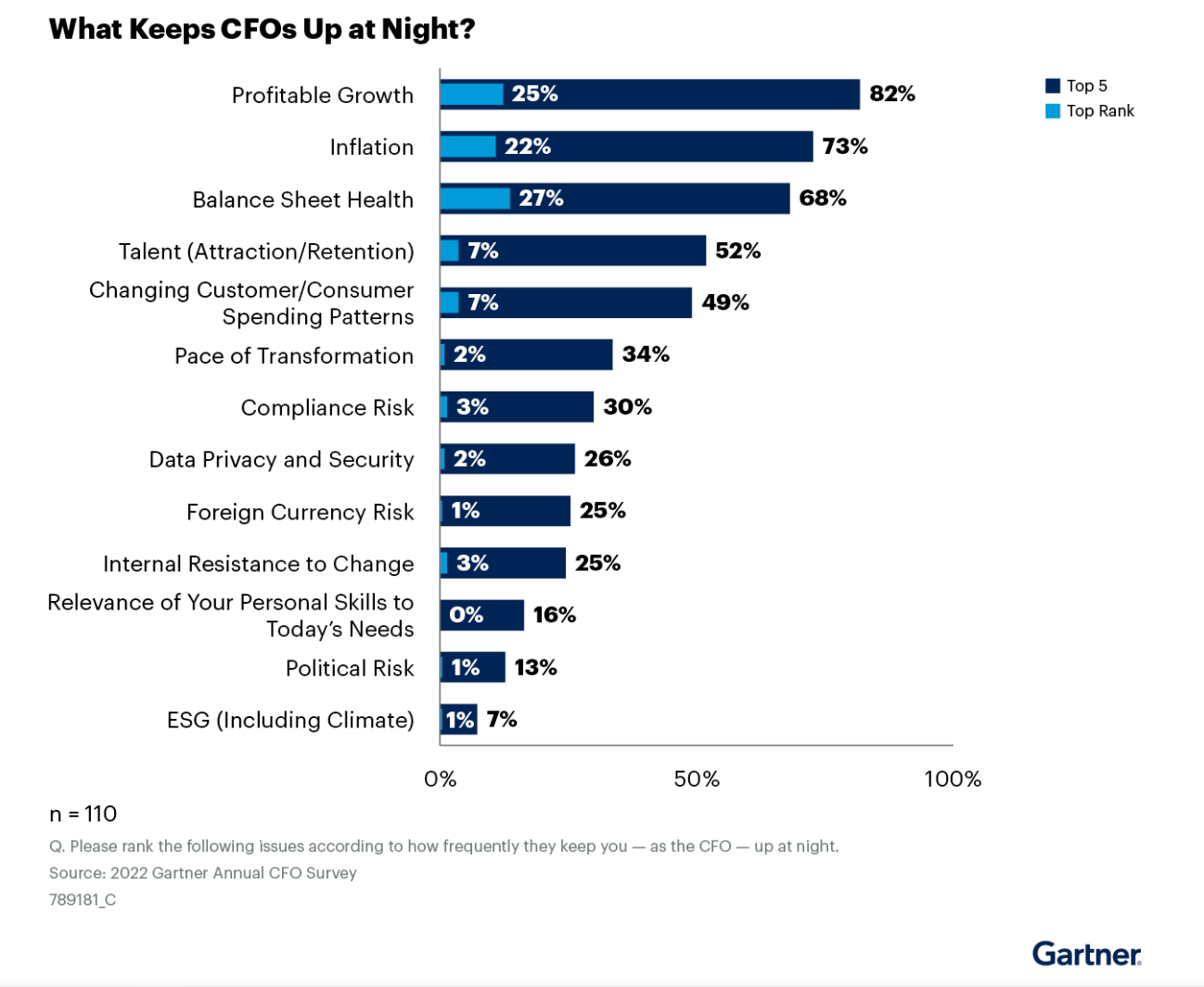

More specifically, CFOs are nervous about their balance sheets. They’re navigating the “triple squeeze” of inflation/rate increases, talent scarcity/cost and global supply imbalances, all of which are creating more volatility for current assets and thus increasing downstream income statement risk. Case in point, the top issue keeping CFOs awake at night, according to Gartner, are ones related to balance sheet health, with profitable growth and inflation close behind:

Compare this with how not only CFOs but also CEOs started the year. As we covered in one of our earlier editions, CEOs started 2023 with a sense of ambition. They acknowledged the stormy waters ahead, but they stated their goals with a willingness to guide their businesses toward calmer shores. Looking across all of the major annual CEO sentiment surveys, the consensus CEO priorities for 2023 were:

- Retaining and attracting talent

- Investing for future business growth

- Accelerating digital transformation

- Building resilience for key enterprise risks

- Mitigating climate (regulatory) risk

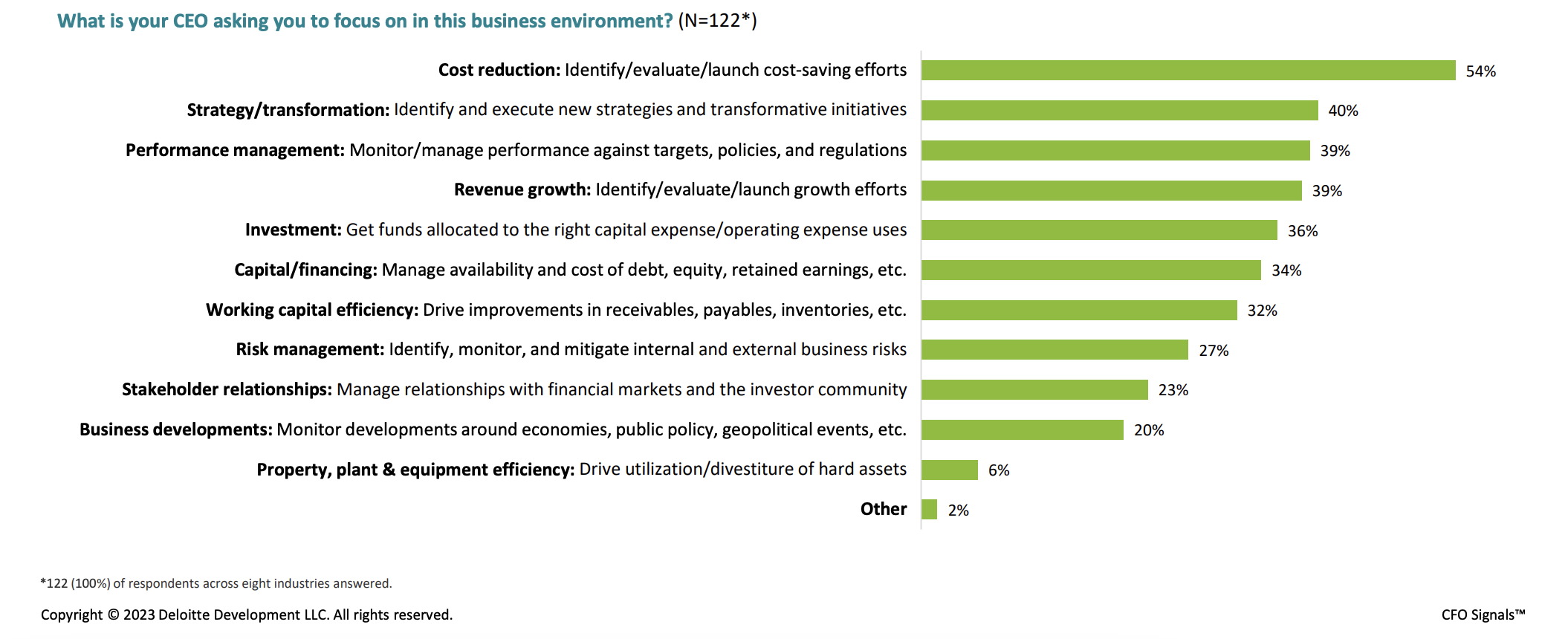

Now those priorities are getting a reality check. To mitigate rising balance sheet risks, CEOs are redirecting their finance leaders. Growth is still on the agenda, but below and next to two rising priorities: cost reduction and performance management:

The takeaway: CEOs and boards are now trying to find a bridge to growth. But that bridge will need to be built from a thicket of operating and labor efficiencies.

Optimizing for spend control

It’s no secret that when recession jitters hit, executives start looking for savings opportunities. Mark Zuckerberg probably called 2023 the “Year of Efficiency” for Meta because “Year of Lowering Costs with Headcount Reductions” is kind of hard to say.

Yes, when CEOs and CFOs talk about cost reduction, they are often implying headcount reductions. But the unique context of this economic environment has finance leaders looking at trade offs rather than following the classic playbook. According to CFO.com’s Q2 2023 Outlook survey, execs are identifying many ways they wish to cut costs. Besides layoffs and outsourcing, CFOs aim to do things like increase efficiency (36%), cut operating costs (26%) and partner with more cost-effective suppliers (26%).

The emphasis on efficiency is one we see across surveys and priorities lists. The top way CFOs are planning to combat inflation and a tough labor market — that is, one still pushing employee wages higher and seeing job churn — is to double down on digital and automation. The generative AI hype wave has only put more fuel on this fire, as executives eye new areas to apply automation.

Case in point, Gartner found in its recent CFO flash survey that 46% reported they planned to scale up enterprise digital initiatives in the next two years. What’s more, nearly one-quarter of CFOs cited greater automation as the main step they’ll take to combat inflation, with an emphasis on back-office operations automation and pricing optimization analytics to improve efficiency.

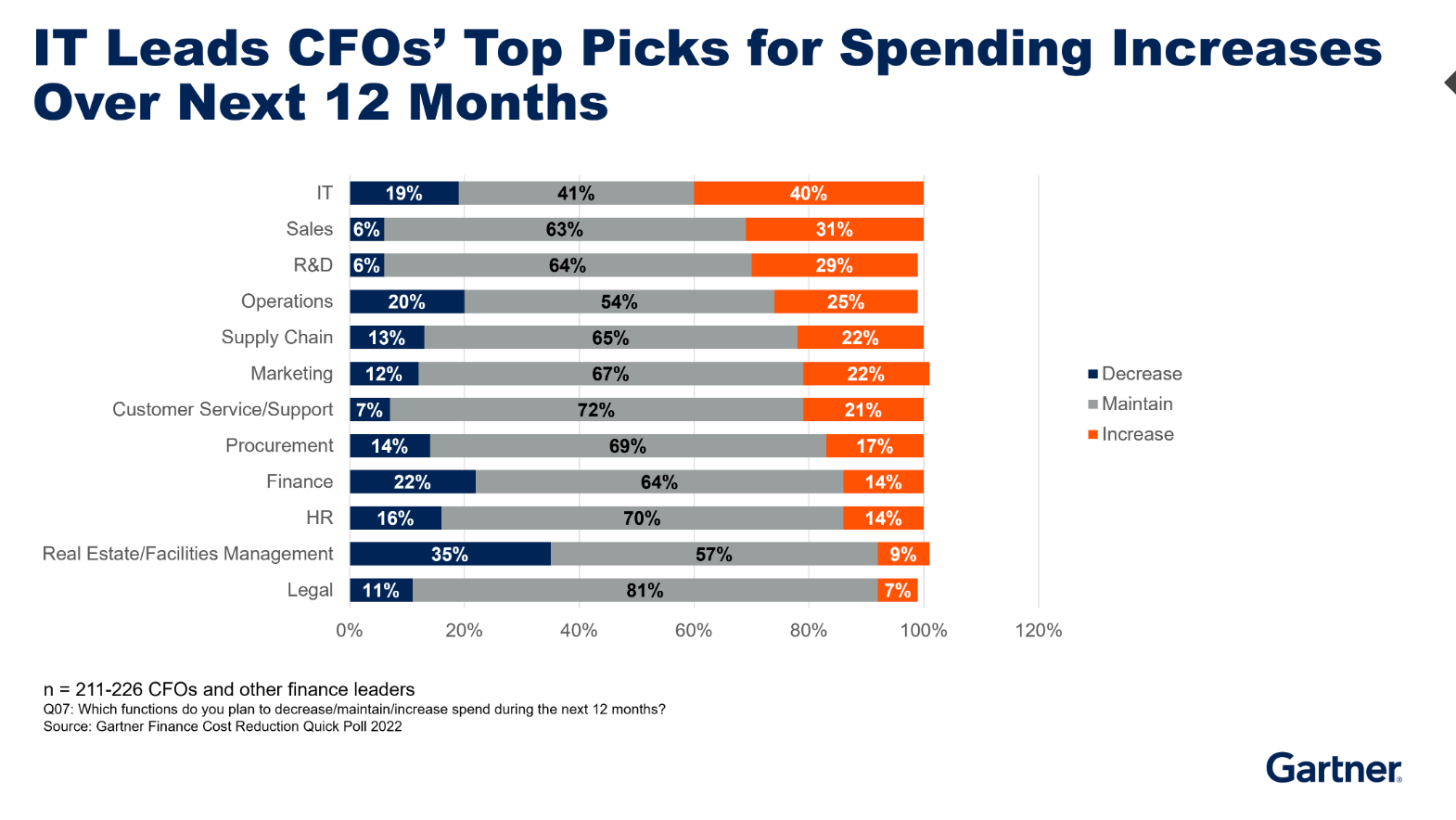

When you look at the places CFOs plan to make those digital investments, however, you see a telling trend: they view automation as being centrally planned and deployed by IT, rather than by other functions:

Finance, procurement and operations functions can expect relatively stable funding, with some up or down depending on the company. But in an era where talent is hard to come by and workloads for back office functions are only increasing, the status quo investment may to procurement leaders feel like an underinvestment.

This is especially true as CFOs try to reign in operating costs. Anecdotally, I have heard of finance leaders at cash-strapped companies pulling their approval thresholds drastically down to hundreds of dollars. Such aggressive approval standards create tighter controls, but they also place increased burdens on finance or procurement personnel to review those requests. (You can’t just stop spending money if you expect to survive, after all.)

One possible consequence of this push for tighter controls combined with IT-led automation and static back office investments could be the redistribution of some purchase request and approval work onto budget holders themselves, combined with intake-to-procure automation to make the workload more manageable. As the CFO of one fintech startup recently told me, there’s no one who cares more about savings than a budget holder trying to hold onto his or her resources; giving those leaders the tools they need to see and control their budgets is one way to do just that.

Homing in on cash management

Beyond saving money through efficiencies and reducing enterprise-level risks, CFOs are also dealing with the ripple effects of 2023’s biggest economic event: the collapse of Silicon Valley Bank.

As we covered in an edition immediately following the SVB news, CFOs read the writing on the wall very quickly. They immediately started diversifying their banking relationships and began exploring the applicability of treasury management technology far earlier (and with more urgency) than previously expected.

That need to mitigate exposure to systemic risk has translated into shifted cash management strategies. According to one recent liquidity survey from the Association for Finance Professionals, less than half (47%) of surveyed companies’ cash reserves were parked in banks as of March 2023 — 8 percentage points lower than a year earlier and the lowest level in four years. What’s more, security jumped the agenda for what CFOs prioritize in the cash investment policy, with almost two-thirds (63%) of participants saying safety is the most important objective.

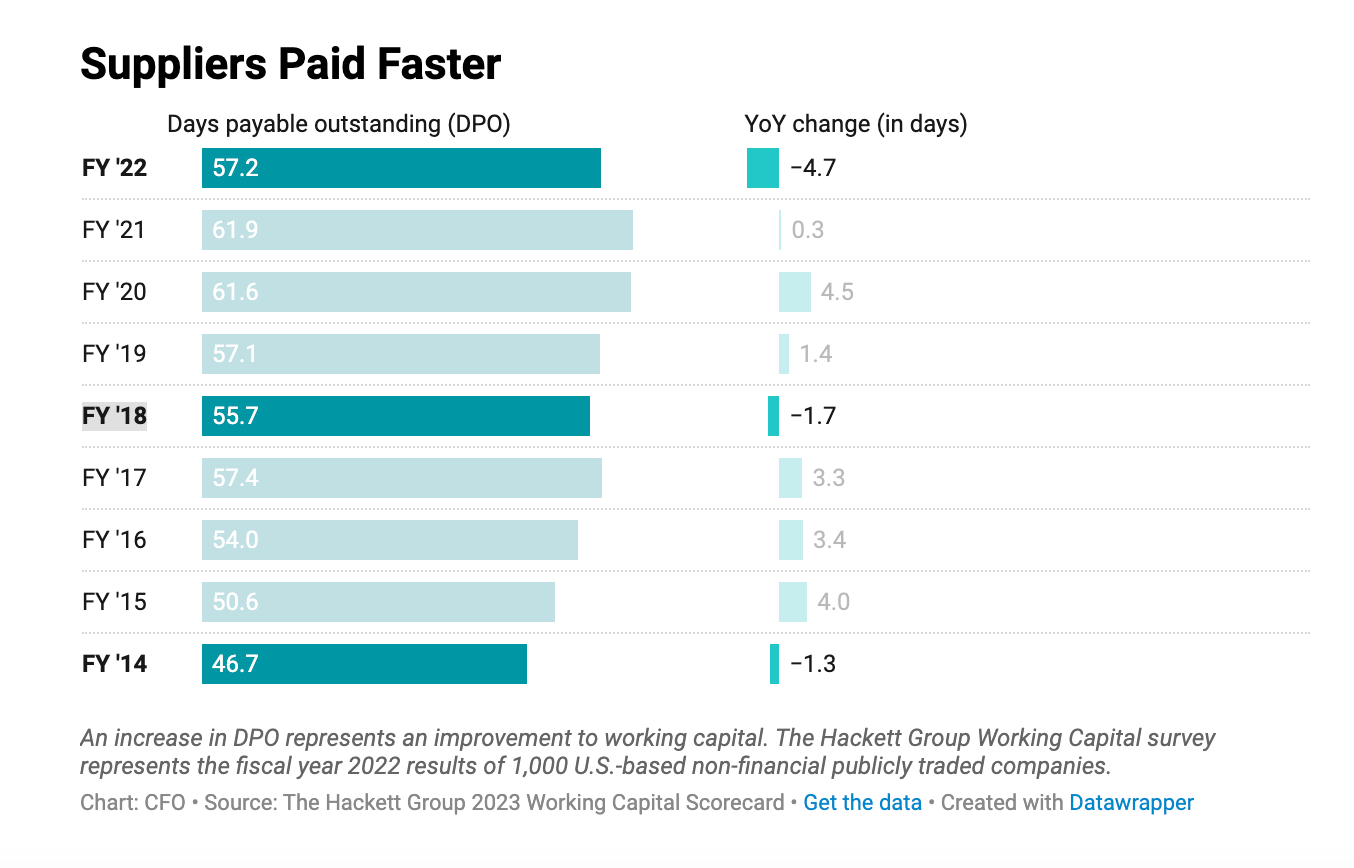

Of course, cash is a double-edged sword to manage. CFOs need to juggle the acceleration of cash collection while balancing obligations with suppliers. Here is where we see a new normal being set by finance leaders in response to pandemic supply disruptions. Cash collection is the top priority, but stretching payment terms to keep more cash on hand — as measured by the days payable outstanding metric — is actually being shunned by CFOs and CPOs.

The reason why, according to the annual Hackett Group scorecard, is that businesses are moving from running “efficient” supply chain models to revenue assurance supply chain models. Buyers are now adapting their supply chain strategies to build redundant supply, as well as identify new secondary suppliers or alternative geographic sources of supply. In this environment, competition for scarce parts and inputs trumps cash management priorities, which has made stretching payment terms less important.

“Supply assurance continues to be a priority for most industries, as companies continue to balance the trade-off between just-in-time and just-in-case,” said Shawn Townsend, a director at the Hackett Group.

Accordingly, the payables category in the Hackett report produced a widespread change. While over the past decade large companies were pushing payment terms out as far as possible — think payment in 120 days — large companies this year said they paid suppliers faster in 36 of the 49 industries evaluated. Last year, however, days payable outstanding (DPO) decreased 4.7 days, to 57.2, after hitting a 10-year high of 61.9 in 2021.

Accelerating revenue collection, on the other hand, is where CFOs are focusing. “Companies acted to collect receivables faster and prevent the erosion of money’s purchasing power caused by high inflation,” noted analysts from The Hackett Group. The study found that for the 1,000 companies studied, days sales outstanding (DSO) fell 1.9 days, to 38.7, the lowest it’s been since 2016. Thirty-three of the 49 industries improved DSO performance.

Carving a path through the new not-normal

If one thing should be clear from this tour of shifting CFO priorities, it’s that volatility is the new normal. There is no new normal on this “other side” of the pandemic; instead, there are a series of shocks and pivots to continuously digest. In response, CFOs are emphasizing the need to be both lean and agile, so they can tackle new opportunities as they arise.

Yet that puts CFOs in a difficult balancing act. They need to selectively invest while protecting financial and organizational health in an unpredictable environment. They may be trying to slash their way through the forest to find a way out of this economic jungle, but they risk excessive cuts and failed automation attempts akin to deforestation if they remove too much deadwood, as the declining DPO metrics show. To adapt, finance leaders need visibility and control first and foremost, so they can optimize proactively and flexibly for whatever hits them next.

Enjoy this newsletter?

Sign up yourself if this was forwarded from a friend or colleague.

Need help with something? Hit reply to send us research questions or to say hello. We love to trade notes!

Interested in hearing more from Zip? Visit our website or sign up for company updates.

Note: By clicking subscribe you confirm that you have read and understood the Zip Privacy Notice that explains how we collect and use your personal information, and includes directions on opting out from our newsletter. If you have any questions, please reach out to privacy@ziphq.com.